In today’s fast-paced world, where online shopping has become the norm, consumers are constantly seeking convenient and flexible payment options. Recently the concept of “Buy Now, Pay Later” has become popular in India. In this article, we will explore the features and benefits of this payment method. We will discuss how it works, and highlight some of the popular BNPL apps available in India.

Quick Points:

What is Buy Now Pay Later?

Buy Now Pay Later is a flexi payment model which allows consumers to make purchases and delay payment for a later date. It offers an easy and trustable alternative to traditional payment methods like credit cards or immediate online payments. Buy Now Pay Later (BNPL) payment option allows customers to split their purchases into smaller, interest-free instalments over a predetermined period. This flexibility enables customers to make essential purchases without straining their budgets or resorting to credit cards or loans.

Who is eligible for Buy Now Pay Later?

The applicant must be at least 18 years of age and should be a resident of India. Maximum age of an applicant can be 65 years. Only salaried individuals or with a Valid PAN Card are eligible for this loan. Minimum monthly income of the applicant should be as per the predefined criteria of as laid out by the lender.

How Does Buy Now Pay Later Work?

Buy Now Pay Later process typically involves the following steps:

Step 1: Selecting Buy Now Pay Later as the Payment Option

At checkout, customers on e-commerce platforms or mobile apps can opt for a Buy Now Pay Later (BNPL) option instead of paying the full amount upfront.

.

Step 2: Creating an Account with a BNPL Provider

To avail of the Buy Now Pay Later service, customers need to create an account with a BNPL provider. This involves providing personal information and undergoing a verification process.

Step 3: Approval and Credit Limit

After completing the registration, the BNPL provider assesses the customer’s creditworthiness and assigns a credit limit based on various factors such as income, credit score, purchasing habits, and repayment history. Your CIBIL score and previous paying bills history play a role in getting easy approval.

Step 4: Making a Purchase

Once approved, customers can use the Buy Now Pay Later option to make a purchase. The merchant receives payment from the BNPL provider, and the customer repays the BNPL provider over a specified period.

Step 5: Repayment

Customers are required to repay the purchase amount in installments as per the agreed-upon terms and conditions. These installments may include additional charges such as interest or processing fees, depending on the BNPL provider.

Advantages of Buy Now Pay Later

Let see the advantages to using Buy Now Pay Later services:

1. Convenience: BNPL allows customers to buy products immediately without having to pay the full amount upfront. This can be particularly useful when there is a need or desire to acquire a product or service promptly.

2. No Interest or Low-Interest Options: Some BNPL providers offer interest-free installment plans or low-interest rates, making it an attractive option compared to credit cards or personal loans.

3. Easy Application Process: Signing up for a BNPL service is typically quick and straightforward, with minimal documentation requirements.

4. Budget-Friendly Repayment: By breaking down payments into smaller installments, BNPL allows individuals to better manage their budgets. It enables them to spread out their expenses over time, making it easier to accommodate larger purchases within their financial means.

4. Financial Flexibility: BNPL offers an alternative to traditional credit cards or personal loans. It can be beneficial for those who do not have access to credit cards or prefer not to utilize them for various reasons.

5. Access to Products and Services: BNPL can provide individuals with the opportunity to access products or services that they might not be able to afford outright. It allows them to make purchases and pay for them over time, making certain items more attainable.

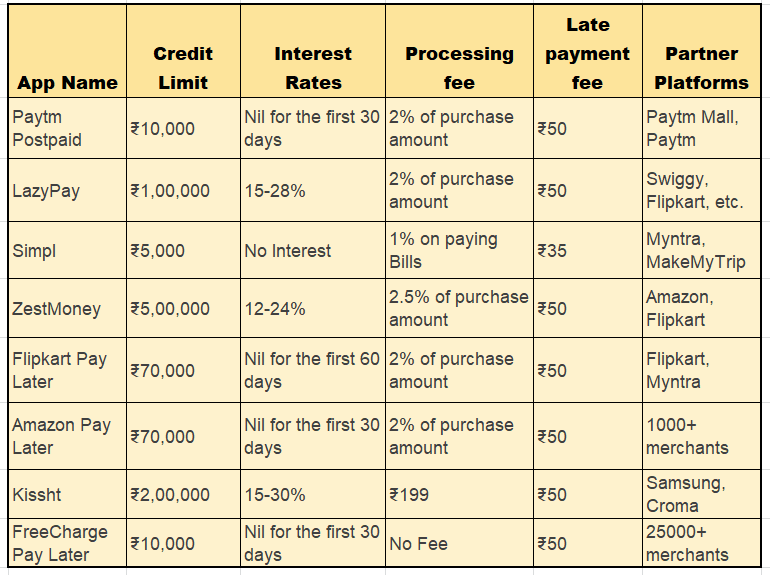

Popular Buy Now Pay Later Apps in India

Let’s take a look at some of the popular Buy Now Pay Later Apps:

Simpl: Simpl is another popular BNPL app that simplifies the payment process for customers. It allows users to split their online purchases into interest-free installments. Simpl has partnered with over 1000 merchants, including Amazon, Flipkart, and Myntra. Simpl does not charge any fees for using its BNPL service. However, there is a processing fee of 1% if you use Simpl to pay a bill.

Paytm Postpaid: Paytm Postpaid is a widely used BNPL service offered by Paytm in India. Paytm Postpaid has partnered with over 1000 merchants, including Amazon, Flipkart, and Myntra. Paytm Postpaid allows users to pay for their online purchases in 30 days without any interest. After that, there is a processing fee of 2% for each transaction. There is also a late payment fee of ₹50 if you do not make your payment on time.

LazyPay: LazyPay provides an instant credit line to customers for making purchases on various e-commerce platforms. LazyPay offers users a credit line of up to ₹1 lakh, which they can use to make purchases at over 2500 merchants. LazyPay also offers interest-free installments on select purchases. LazyPay is popular BNPL service in India. LazyPay charges a processing fee of 2% for using its BNPL service. There is also a late payment fee of ₹50 if you do not make your payment on time.

ZestMoney: ZestMoney offers a digital credit line to customers, enabling them to make purchases on partner platforms and repay the amount in installments. Interest: There is no interest charged on BNPL purchases made through ZestMoney for the first 30 days. After that, there is an interest rate of 18% per annum. There is a processing fee of 2.5% of the purchase amount for BNPL purchases made through ZestMoney. There is a late payment fee of ₹50 for BNPL payments that are made after the due date.

Kissht: Kissht is a leading BNPL app in India that offers instant credit to customers for online and offline purchases. It provides attractive interest rates and flexible repayment options. There is no interest charged on BNPL purchases made through Kissht for the first 30 days. After that, there is an interest rate of 18% per annum. There is a processing fee of 2% of the purchase amount for BNPL purchases made through Kissht. There is a late payment fee of ₹50 for BNPL payments that are made after the due date.

Flipkart Pay Later: Flipkart Pay Later is a BNPL service offered by Flipkart. Flipkart Pay Later allows users to pay for their online purchases in 30 days without any interest. Flipkart Pay Later has partnered with over 2000 merchants, including Flipkart and Myntra. Flipkart Pay Later does not charge any fees for using its BNPL service for the first 60 days. After that, there is a processing fee of 2% for each transaction. There is also a late payment fee of ₹50 if you do not make your payment on time.

Freecharge Pay Later: Freecharge has partnered with over 25,000 merchants online and offline across India to offer its BNPL service. Freecharge Pay Later includes- Amazon, Flipkart, Myntra, BigBasket, Decathlon, Swiggy, Zomato, Uber, and many more. Offline merchants, such as Reliance Digital, Croma, Lifestyle, Westside, and many more. Freecharge Pay Later offers a 30-day interest-free period on all purchases. After that, there is an interest rate of 18% per annum. There is also a processing fee of 2% of the purchase amount.

Amazon Pay Later: Amazon Pay Later is a BNPL service offered by Amazon. Amazon Pay Later allows users to pay for their online purchases in 30 days without any interest. Amazon Pay Later has partnered with over 1000 merchants, including Amazon, Flipkart, and Myntra. Amazon Pay Later does not charge any fees for using its BNPL service for the first 30 days. After that, there is a processing fee of 2% for each transaction. There is also a late payment fee of ₹50 if you do not make your payment on time.

Comparison of BNPL Apps Available in India

Smart Tips for Safe Buy Now Pay Later Usage

While Buy Now Pay Later can be a convenient payment option, it’s essential to use it responsibly. Here are a some tips to keep in mind:

1. Stick to a Budget: Utilize BNPL for necessary purchases and avoid impulsive buying. Before making a purchase, ensure that you can comfortably repay the installment amounts without straining your finances.

2. Understand the Terms and Conditions: Thoroughly understand the terms, including interest rates, fees, and penalties associated with the BNPL service. Be aware of all the financial implications before making a purchase

3. Budget Planning: Use Buy Now Pay Later for essential purchases and avoid excessive spending or unnecessary impulse buys.

4. Timely Repayments: Make sure to repay the installments on time. Set reminders or automate payments to avoid late fees and negative impacts on your credit score.

5. Monitor Your Spending: Keep track of your BNPL transactions and overall expenditure to ensure you are within your financial limits. Regularly review your spending and repayment patterns to maintain control over your finances.

The Future of Buy Now Pay Later

The BNPL market in India is expected to continue to grow in the coming years. The supporting factors for BNPL includes the increasing popularity of online shopping, the growing number of credit-worthy consumers, and the convenience of BNPL services.

Last Note

- Buy Now, Pay Later has emerged as a game-changing payment option for Indian consumers.

- It offers flexibility, convenience, and accessibility, revolutionizing the way Indians shop and pay.

- This payment method empowers individuals to make purchases without immediate financial strain.

- It supports responsible financial planning and has become a preferred choice for many Indian shoppers.

- Buy Now, Pay Later is expected to reshape the retail industry and provide more benefits in the future.

Frequently Asked Questions (FAQs)

Is Buy Now Pay Later available only for online purchases?

No, Buy Now Pay Later can be used for both online and offline purchases. Many BNPL apps have tie-ups with offline retail stores, allowing customers to avail of the service across various shopping channels.

Are there any eligibility criteria to use Buy Now Pay Later services?

Yes, you must be in age 18 to 65, a resident of India, a Valid Pan Card holder, Salaried, or with good Credit History.

What all BNPL evaluate before providing BNPL credit to customers?

BNPL service provider evaluates customers based on factors like credit score, income, and repayment history. Meeting the eligibility criteria increases the chances of approval and a higher credit limit.

Can I use multiple BNPL apps simultaneously?

Yes, you can use multiple BNPL apps simultaneously, as long as you manage your repayments responsibly. However, it is advisable to keep track of your overall credit utilization and avoid excessive borrowing.

What happens if I miss an installment payment?

Missing an installment payment may attract late fees or penalties, depending on the BNPL provider’s terms and conditions. It can also negatively impact your credit history and future credit opportunities. It lowers your CIBIL score.

Is Buy Now Pay Later interest-free?

Not all Buy Now Pay Later services are interest-free. Some providers may offer interest-free installments for specific purchases or promotional periods, while others charge interest based on the repayment terms.